Individual Life Fund

As directed by IRDA (Insurance and Regulatory Development Authority) vide circular no.F&I/INV/CIR/213/10/2013, It has been decided to consider NSE as Primary exchange and BSE as secondary exchange for valuation of equity and equity related instruments. Therefore valuation will be done on the closing price of primary exchange; if security is not traded on primary exchange then closing price of secondary exchange will be considered for valuation.

Please note that IRDA (Insurance Regulatory and Development Authority) has issued a Circular,Cir.No IRDA/FI/CIR/INV/234/10/2011, directing the Insurers to convert various funds offered below fund of funds structure, to individual segregated fund with a unique SFIN (Segregated Fund Identification Number) with identified 'scrips' representing the investments of such segregated funds.

In line with the above, we have converted our fund of funds namely,Tata AIA Life Growth fund and Tata AIA Life Balanced fund into segregated funds having segregated portfolio and NAV. Please note that the above change is effective from 16th December 2011. We also confirm that there is no change in the number of units to the credit of any policyholder on account of this change.

As stipulated by the Insurance and Regulatory Development Authority (IRDA), in its circular dated July 29, 2011 the formula for computation of the Net Asset Value Per Unit (NAV) for Linked funds stands modified.

Old formula as prescribed by IRDA and as contained in the policy document:

Market value of the investment plus / (minus) expenses incurred in the purchase / (sale) of assets plus current assets and accrued interest (net of fund management charges) less current liabilities and provisions, divided by, number of units outstanding under the fund at valuation date (before creation / redemption of units).

Modified formula as stipulated by IRDA effective August 16, 2011:

Market value of the investment held by the fund plus value of current assets less value of current liabilities and provisions, if any and divided by the number of units existing on the valuation date (before creation/redemption of units) The policy document shall accordingly stand modified.

Details of Closed ULIP Funds and Discontinuation of NAV Declaration

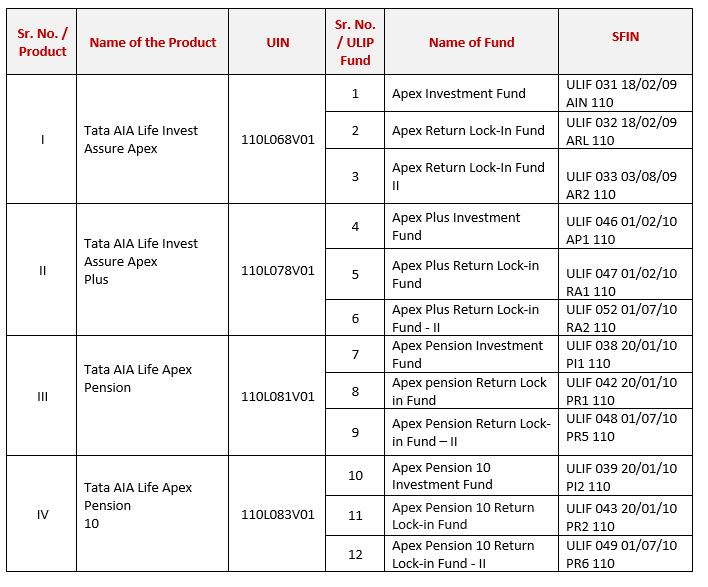

Following 12 ULIP Funds (SFIN) stand closed on account of maturity of the policies and withdrawal of the product for sale.

Therefore, the declaration of its daily NAV has been discontinued with effective September 17, 2021.

Details of Closed ULIP Funds and Discontinuation of NAV Declaration

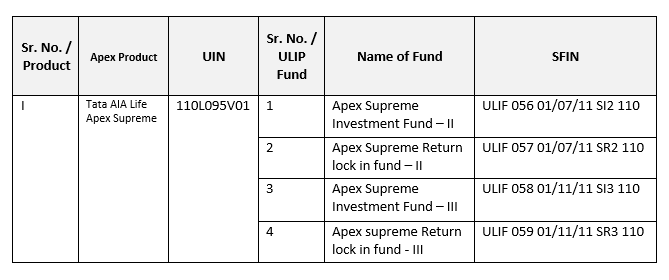

Following 4 ULIP Funds (SFIN) stand closed on account of maturity of the policies and withdrawal of the product for sale. Therefore,

the declaration of its daily NAV has been discontinued with effective September 23, 2022.